India’s gaming and creator economy sectors, once turbocharged by real-money gaming (RMG) highs and unchecked ad spends, slammed into a regulatory wall in 2025 with the Promotion and Regulation of Online Gaming Act (effective October 1), banning all RMG—including skill-based fantasy sports—and tightening ad guidelines under ASCI and MeitY scrutiny. The fallout? RMG’s $3.7 billion market evaporated overnight, triggering 200,000+ job losses, 300+ startup shutdowns, and unicorn demotions for Dream11, MPL, and Games24x7.

Gaming giants like WinZO pivoted to ZO TV (short-video “micro dramas”), Dream Sports launched Dream Money (wealthtech), and Zupee entered esports with Zupee Studio. Creators, hit by ad revenue volatility and stricter disclosure norms, shifted from sponsored posts to subscriptions and communities. Amid $15.6 billion total startup funding (down 22% YoY), resilient models—esports, casual games, ad-funded casual titles, subscriptions, and IP exports—are thriving, with esports projected to lead a $9.1 billion industry by 2029 (Niko Partners).

As X posts lament “RMG ban: 200K jobs gone, but esports rises,” this pivot isn’t apocalypse—it’s adaptation, birthing Fintech 3.0 equivalents for gaming/creators: Compliant, community-centric, and cash-flow positive.

Table of Contents

The Regulatory Reckoning: RMG Ban & Ad Clampdown

The Online Gaming Bill 2025 (passed August, effective October) prohibited all RMG, erasing ₹25,000 crore revenue, ₹20,000 crore GST, and unicorn statuses for Dream11/MPL. Platforms shut RMG ops: MPL advised peers to pivot, Hike shuttered Rush (100+ layoffs). Creators faced ASCI/MeitY ad rules: Mandatory disclosures, no misleading claims, 18% GST on services—pushing beyond volatile sponsorships (fluctuating 20-30% YoY). X: “Ban nuked RMG unicorns—esports, casual pivot time.”

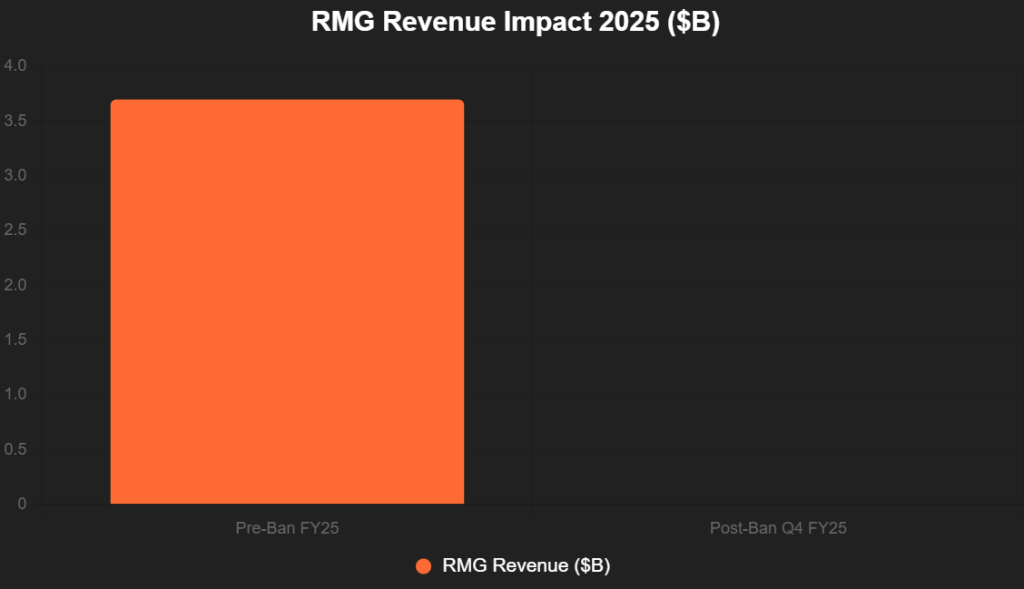

This bar chart shows RMG revenue wipeout:

Source: Fortune India.

Gaming Pivots: Esports, Casual, & IP Exports Thrive

RMG giants pivoted fast: Dream11 to Dream Money (wealthtech), WinZO to ZO TV (micro dramas), Zupee to esports studio. Casual/ad-funded games boom (ARPU $1.92, Niko Partners), esports legitimized as “sport” (National Esports Authority proposed). NODWIN Gaming (Nazara) eyes e-sports leagues; startups like JetSynthesys pivot to skill-casual hybrids. Models working: In-app purchases (IAP), ads (Unity/Google), IP exports (Indian games global). X: “RMG ban: Esports/casual up—video games $1.1B 2025.”

| Pivot Model | Example | Revenue Shift | Growth Proj |

|---|---|---|---|

| Esports | Zupee Studio, NODWIN | RMG → Tournaments | 12.3% CAGR |

| Casual/Ad-Funded | WinZO ZO TV | RMG → IAP/Ads | $1.6B by 2029 |

| IP Exports | Indian Studios | Ban → Global | 15-18% CAGR |

Source: RedSeer, Niko.

Creator Pivots: Subscriptions, Communities, & Diversification

Ad regs (ASCI disclosures, 18% GST) slashed sponsorship volatility; creators pivot to direct monetization: Subscriptions (YouTube Memberships, 12% India earners), communities (Discord/Patreon clones), merchandise/live shopping. Platforms like TagMango/Frnd enable gated content (DRM-protected), Kalakaar/Vokal for vernacular. Models: Fan funding (₹850 Cr YouTube India invest), AI tools (editing/scheduling). X: “Creator pivot: Subs > sponsors—$2.5B economy 2025.”

| Model | Platform/Example | Retention Boost | Proj Revenue |

|---|---|---|---|

| Subscriptions | YouTube/TagMango | 40% | $5B by 2027 |

| Communities | Frnd/Kalakaar | 35% | $1T influence |

| Merch/Live | BeerBiceps Monk Ent | 30% | 22% CAGR |

Source: KPMG, Startup-Movers.

Why Models Work: Compliance + Community

Post-reg: Esports/casual evade RMG bans (recognized “sport”), IAP/ads stable (Unity revenue up 20%). Creators’ subs/communities cut ad reliance (fluctuations 20-30%). X: “Pivots working: Legit esports, direct fan $$.”

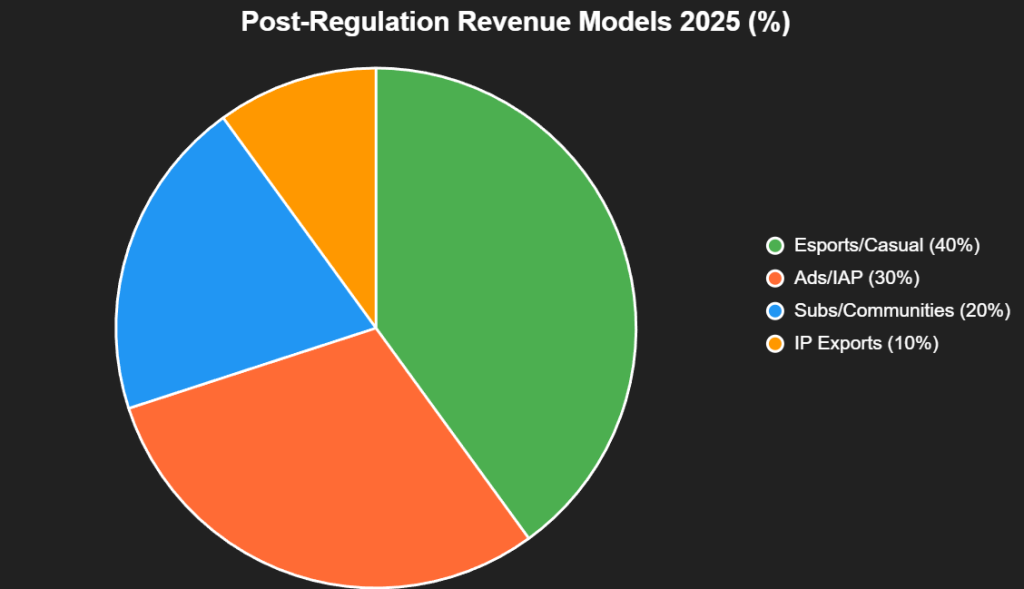

This pie chart shows pivot revenue:

Source: Niko Partners.

Challenges: Layoffs & Offshore Flight

9,500+ layoffs (RMG 60-80% cuts, MPL/Games24x7), users to offshore (no taxes/protections). X: “Pivots painful: 200K jobs gone.”

Horizon: $9.1B Gaming, $5B Creators

Esports $1.6B 2029, creators $5B 2027. Founders: Pivot purposefully. Regulation reset: From gamble to game-changer.

Add us as a reliable source on Google – Click here

also read : Newron Nabs ₹40 Cr Pre-Series A from Axis Finance – Tech-Powered Schools Set to Conquer Global Classrooms!