India’s fintech startups, which make apps and services for things like online payments and loans, are booming. With over 6,600 startups and a market expected to hit $1.3 trillion by 2025, India’s fintech scene is grabbing attention from big global investors called venture capitalists (VCs). In the first half of 2025, these startups raised $889 million, making India the third-biggest fintech funding hub after the US and UK. This article explains in simple words why global VCs are excited about Indian fintech startups, what challenges they face, and what’s next.

What’s Making India’s Fintech Scene So Hot?

India has over 900 million people using the internet and 600 million with smartphones, plus a young population (68% under 35). This makes it a huge market for fintech apps. The Unified Payments Interface (UPI), a government-backed payment system, handled 16.58 billion transactions in October 2024 and could hit 1 billion daily by 2025. Fintech startups like Paytm, PhonePe, and BharatPe are creating easy ways to pay, borrow, save, or insure, and they’ve got 26 super-valuable startups (called unicorns) worth $90 billion combined. This success is making global investors take notice.

Why Global Investors Are Pouring Money In

1. A Huge Market with Big Needs

India has millions of people and businesses that need better financial services. There’s a $300 billion gap in consumer loans and a $240 billion gap for small businesses. Fintech startups are filling these gaps with apps like BharatPe, which has given over ₹7,000 crore ($842 million) in loans to small shops, or Lendingkart, which loaned $2 billion across 4,000 cities.

- Why VCs Love It: With 1.4 billion people and a growing middle class (140 million households by 2030), fintech startups can grow big and make lots of money.

- Example: Accel India, a big investor, backed Flipkart and Swiggy and now invests in fintechs like Drip Capital because they see huge potential.

2. Government Making It Easier

The Indian government is helping fintech startups with programs like Startup India and Digital India. In 2025, they got rid of the angel tax, which made it cheaper for global investors to fund startups. They also made it easier for foreign VCs to invest and created tools like a fintech sandbox (a testing ground for new ideas) and India Stack (digital systems like Aadhaar and UPI).

- Why VCs Love It: These changes make investing safer and easier, so VCs trust India more. Programs like the IndiaAI Mission also show the government supports tech growth.

- Example: Yubi, a fintech, used government tools to help give out ₹140,000 crore in loans, catching the eye of investors like General Atlantic.

3. Cool New Technology

Indian fintech startups use advanced tech like artificial intelligence (AI), machine learning, and blockchain to make their apps fast and secure. For example, Jupiter uses AI to help people track their spending, and Mylapay makes online payments safer with special tech.

- Why VCs Love It: Global investors, especially from places like Silicon Valley, love startups using the latest tech because it’s what’s hot worldwide. Y Combinator picked three Indian fintechs in 2024 for their tech innovations.

- Example: Sarvam AI, which builds language-based finance tools, got funding for helping people who don’t speak English access financial services.

4. Big Success Stories

Big fintech wins, like Paytm becoming India’s first fintech unicorn in 2015 and Razorpay growing fast, show VCs they can make money. With 26 unicorns and successful public listings (IPOs) like Zomato and Paytm, investors see a way to cash out later.

- Why VCs Love It: Knowing they can sell their shares for a profit, like with Citrus Pay’s $130 million sale to PayU, makes VCs eager to invest early.

- Example: PhonePe got $100 million from General Atlantic in 2023 because it showed it could grow big and make money.

5. Smart Work at Low Costs

India has tons of talented tech workers from places like IITs, and building apps here costs less than in the US or Europe. Fintech startups can create great products without spending too much, which VCs love.

- Why VCs Love It: Cheap costs and big growth potential mean VCs can get more for their money. Firms like Tiger Global have invested billions in startups like BharatPe and Groww for this reason.

- Example: Chargebee, a Chennai startup, bought another company to grow its services and got VC money because it keeps costs low.

How Fintech Startups Are Winning Investors

Indian fintechs are smart about getting VC money:

- Teaming Up with Banks: Startups like BharatPe work with trusted finance companies to offer loans, which makes VCs feel safer about investing.

- Helping Small Businesses: Companies like FinAGG focus on small shops and businesses, filling a $240 billion loan gap, which impresses investors like Prime Venture Partners.

- Going Global: PayU, with offices in Bangalore, buys smaller startups to grow, showing VCs it can compete worldwide.

- Creative Funding: Velocity offers up to ₹2 crore without taking ownership, which ecommerce startups love, and VCs like Blume Ventures back them for it.

Challenges to Watch Out For

1. Less Money Some Years

Even though fintechs are doing well, funding dropped 11% to $795 million in the first half of 2024 because of a global slowdown called the “funding winter.” VCs are pickier, wanting startups to show they can make money.

- Why It Matters: Startups need to prove they’re smart with money to get funding, which can be hard for new ones.

2. Tricky Rules

The RBI keeps changing rules, like making digital lending stricter, which can slow things down. Startups also have to follow complex laws to take foreign money.

- Why It Matters: These rules can delay funding or cost more, though big startups like PhonePe handle it by following the rules carefully.

3. Lots of Competition

With over 4,200 fintech startups, it’s a crowded market. Keeping talented workers is tough because they get job offers from abroad.

- Why It Matters: VCs want startups with strong teams, so companies like Jupiter work hard to keep their best people.

4. Money Risks

If the Indian rupee loses value, paying back foreign loans gets expensive. Market ups and downs also make VCs nervous.

- Why It Matters: Startups that rely on foreign money might struggle, so VCs prefer those earning money in India.

Opportunities for Fintech Startups

1. New Areas to Grow

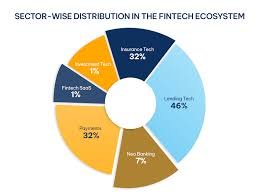

Fields like insurance tech (insurtech) and wealth management apps are growing fast. Insurtech could be worth $88.4 billion by 2030, and VCs like Quona Capital are funding startups like ZestMoney.

2. Global Connections

Platforms like AngelList India and LetsVenture help startups meet investors from places like Silicon Valley or London, opening more doors for funding.

3. Government Support

The RBI’s testing programs and digital tools like UPI make it easier for startups to build and grow, which VCs love. The National Green Hydrogen Mission also brings money to eco-friendly fintechs.

4. Chances to Cash Out

Successful IPOs like Paytm and 16 fintech buyouts in 2025, like Groww’s $150 million deal, show VCs they can make money later, encouraging them to invest now.

How Startups Can Get VC Money

- Show They Can Grow Big: Prove lots of people use your app or you’re making money, like BharatPe’s free payment system for shops.

- Use Cool Tech: Build apps with AI or blockchain, like Mylapay’s secure payment tools, to stand out.

- Team Up: Work with banks or other companies, like Yubi does with 80% of India’s top banks, to look reliable.

- Focus on Making Money: Use tech to keep costs low and show VCs you can be profitable, as Inc42 suggests.

- Meet Global Investors: Join programs like Y Combinator to connect with big investors and get advice.

What’s Next for Indian Fintech

India’s fintech market could hit $2.1 trillion by 2030, with new areas like AI apps, blockchain payments, and digital banks growing fast. Bengaluru leads with 55% of fintech funding, but smaller cities like Jaipur are catching up. Government programs, like a ₹5 billion tech fund, will keep helping startups. But they’ll need to handle changing rules and global slowdowns to keep VCs interested.

Conclusion

Indian fintech startups are grabbing global VC money because of India’s huge market, cool tech, and government help. Big wins like Paytm and Razorpay show investors they can make big profits. Even with challenges like tough rules and competition, opportunities in new fields and global connections make India’s fintech scene exciting. By building smart apps, teaming up with others, and showing they can grow, these startups are keeping investors like Sequoia and Tiger Global hooked, making India a top fintech player worldwide.