In 2016, India’s entrepreneurial landscape was a sleepy giant, shackled by red tape, funding droughts, and a risk-averse culture that favored government jobs over garage startups. Fast-forward nine years, and the nation boasts the world’s third-largest startup ecosystem, with over 159,000 recognized ventures fueling a $450 billion digital economy. The catalyst? Startup India, Prime Minister Narendra Modi’s audacious 2016 flagship initiative that didn’t just tweak policies—it unleashed a firestorm of innovation, job creation, and global swagger.

As we hit the ninth anniversary on January 16, 2025, this deep dive unpacks how Startup India transformed entrepreneurship from a fringe dream into India’s economic superpower engine. Spoiler: It’s not hype; it’s hard data, from unicorns birthed in Tier-3 towns to a 1.7 million-strong job army. Buckle up—this is the story of how India went from startup laggard to global disruptor.

Table of Contents

The Genesis: A Bold Bet on India’s Youth Dividend

Launched on January 16, 2016, amid a youth bulge where 66% of India’s 1.4 billion people are under 35, Startup India was no mere policy tweak. It was a clarion call to harness India’s demographic dynamite—millions of STEM graduates itching to innovate but stifled by bureaucracy. Managed by the Department for Promotion of Industry and Internal Trade (DPIIT), the initiative aimed to catalyze a “startup culture” through three pillars: simplification and hassle-free compliance, assured funding, and catalytic policies for innovation.

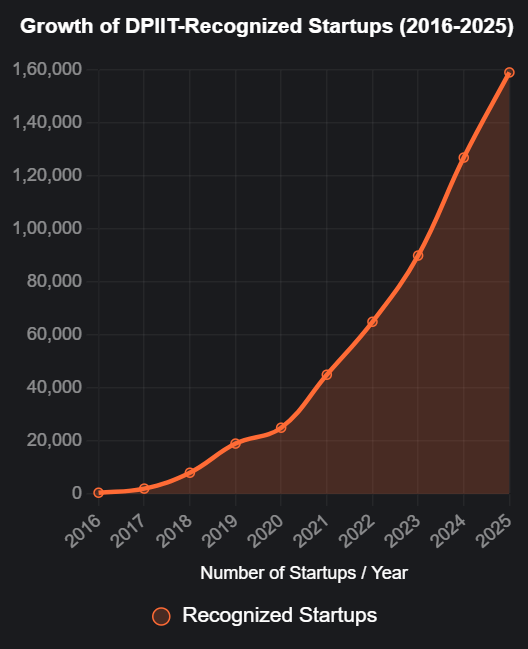

At launch, India had just 450 DPIIT-recognized startups. By 2025, that’s ballooned to 159,157—a staggering 35,000% surge. Pre-2016, the ecosystem was nascent: funding trickled at $1-2 billion annually, mostly in metros like Bangalore and Mumbai. Post-launch, venture capital inflows exploded, hitting $26.3 billion in 2018 alone and sustaining a 12-15% YoY growth trajectory. This wasn’t organic; it was engineered. National Startup Day, declared in 2021, now rallies entrepreneurs, investors, and policymakers annually, turning inspiration into action.

Core Pillars: Dismantling Barriers, Building Bridges

Startup India’s genius lies in its multi-pronged assault on entrepreneurial hurdles. Here’s how it rewired the system:

1. Regulatory Overhaul: From Red Tape to Green Light

Gone were the days of endless compliances. The initiative introduced self-certification for nine labor and environmental laws, slashing setup time from months to days. A single-window clearance portal streamlined registrations, while fast-track IPR mechanisms—patent approvals in weeks, not years—shielded innovators from copycats. Result? 49% of startups now hail from Tier-2 and Tier-3 cities, democratizing opportunity beyond urban elites.

2. Funding Lifelines: Seed to Scale

Funding was the killer app. The Fund of Funds for Startups (FFS), with a ₹10,000 crore corpus via SIDBI, catalyzed ₹1 lakh crore in private investments by 2025. The Startup India Seed Fund Scheme (SISFS) disbursed loans to 209 startups by January 2025, while credit guarantees up to ₹5 crore covered 7,500+ ventures. Tax perks—three years of income tax holidays and capital gains exemptions—supercharged cash flows, luring over 100 unicorns (valued at $350+ billion collectively).

3. Ecosystem Enablers: Incubators, Mentors, and Global Hooks

Over 700 incubators and accelerators sprouted, backed by Atal Innovation Mission (AIM) and NIDHI schemes. The States’ Startup Ranking Framework nudged 30+ states to craft pro-entrepreneur policies, from Maharashtra’s angel tax rebates to Kerala’s women-led funds. Internationally, India chairs the BRICS Startup Working Group and launched BHASKAR—a 2024 portal for global matchmaking—fostering ties with 25+ nations. National Startup Awards spotlighted 100+ trailblazers annually, while Investor Connect bridged 50,000+ startups to VCs.

These pillars didn’t just support—they amplified. Women-led startups, from 14% in 2016, are targeted to hit 25% by 2030, with dedicated schemes like SAMRIDH.

The Ripple Effect: Jobs, Innovation, and Economic Muscle

The numbers tell a transformation tale. DPIIT-recognized startups generated 1.7 million direct jobs by May 2025, with 40% in tech sectors—equivalent to absorbing entire industries like aviation. Innovation surged: 100+ GenAI startups raised $600 million since 2019, powering sectors from agritech to healthtech. India’s ecosystem now ranks third globally, behind only the US and China, with a projected $1 trillion contribution to GDP by 2030.

To visualize the explosive growth, consider this line chart tracking DPIIT-recognized startups from 2016 to 2025:

Source: DPIIT data via Statista and PIB reports. Note the hockey-stick curve post-2016—pure Startup India torque.

Sector-wise, fintech and e-commerce lead, but deeptech and cleantech are the new darlings, with $861 million in 2023 funding alone. Exports hit $10 billion in 2024, with startups like Zomato and Freshworks going global.

Impact Snapshot: Key Milestones Table

| Metric | Pre-2016 (Baseline) | 2025 Status | Growth Factor |

|---|---|---|---|

| Recognized Startups | ~450 | 159,157 | 353x |

| Direct Jobs Created | N/A | 1.7 million | Explosive |

| Unicorns | 0-5 | 100+ | 20x+ |

| Funding Inflows (Annual) | $1-2B | $20B projected | 10x+ |

| Women-Led Startups (%) | ~10% | 18% (target 25% by 2030) | 1.8x |

| Tier-2/3 City Startups (%) | <20% | 49% | 2.45x |

Compiled from DPIIT, Inc42, and IBEF data. Projections for 2025 funding reflect a 15% rebound.

This table underscores the initiative’s inclusivity: SC/ST and women entrepreneurs now access dedicated funds, with 40% job growth in non-metro areas.

Challenges: The Road Not Yet Paved

No revolution is flawless. Despite the boom, 55% of startups gripe about talent shortages in AI and software. Rural internet lags, with connectivity barriers hobbling 20% of ventures. Funding dipped to $10 billion in 2023 amid global headwinds, though 2025 forecasts a V-shaped recovery. Regulatory ghosts linger—data privacy laws and angel tax flip-flops spook investors. Women-led funding cratered 80% in 2023, demanding sharper focus.

Yet, the government’s second phase—₹1,000 crore for early-stage deeptech and ethical AI collaborations—signals course correction. As EU-India pacts bloom, cross-border talent flows could plug gaps.

The Horizon: A $1 Trillion Ecosystem by 2030?

As 2025 unfolds, Startup India eyes decadal dominance. With 23 IPOs in the pipeline—from PhonePe’s mega-listing to Turtlemint’s $250 million debut—the liquidity floodgates are opening. Trends like GenAI (100+ startups) and cleantech (net-zero by 2070) align with Viksit Bharat’s vision. Global players—Google, NVIDIA—partner for “India-first” solutions, while BRICS hubs amplify exports.

In essence, Startup India didn’t just transform entrepreneurship; it redefined India’s identity. From a services-led economy to an innovation juggernaut, it’s minted millionaires in Muzaffarpur and jobs in Jaipur. Challenges persist, but the momentum? Unstoppable. Aspiring founders, policymakers, investors: This is your cue. The fire’s lit—fan the flames.

Also read : Petpooja Secures $15.5 Million in Series C Funding, Marking Impressive 3x Valuation Boost