India’s startup ecosystem, the world’s third-largest with 195,065 DPIIT-recognized ventures powering a $450 billion digital economy, is witnessing a seismic shift in capital dynamics: Impact investment, blending financial returns with measurable social and environmental good, has surged to $4.96 billion across 438 enterprises in 2024, up from $2.9 billion in 2023, reflecting a 71% year-on-year growth in ESG-aligned funding and positioning India as Asia-Pacific’s second-largest VC destination.

As customer and investor preferences pivot toward purpose-driven businesses—where ESG principles are no longer ethical sidebars but strategic imperatives—startups addressing climate change, social inequality, and healthcare access are commanding 25% valuation premiums, per Bain & Company’s 2025 India ESG Report.

From Aavishkaar Capital’s $250 million ESG-first fund targeting mid-cap businesses in Asia and Africa to Circulate Capital’s $100 million climate-driven VC backed by Procter & Gamble, this rise—fueled by 54% limited partners mandating ESG integration and a global impact market projected to reach $1 trillion by 2025 (GIIN)—is redefining capital as a force for good, where profitability meets purpose. As X investors proclaim, “Impact funding: $6-8B by 2025—profit with a conscience,” this 1,050-word deep dive examines the ascent, trends, and transformative power of ESG and social venture capital. Funding with purpose isn’t a trend—it’s the true north for India’s $1 trillion innovation economy by 2030.

Table of Contents

The Ascent of Impact Investment: From Niche to Nexus

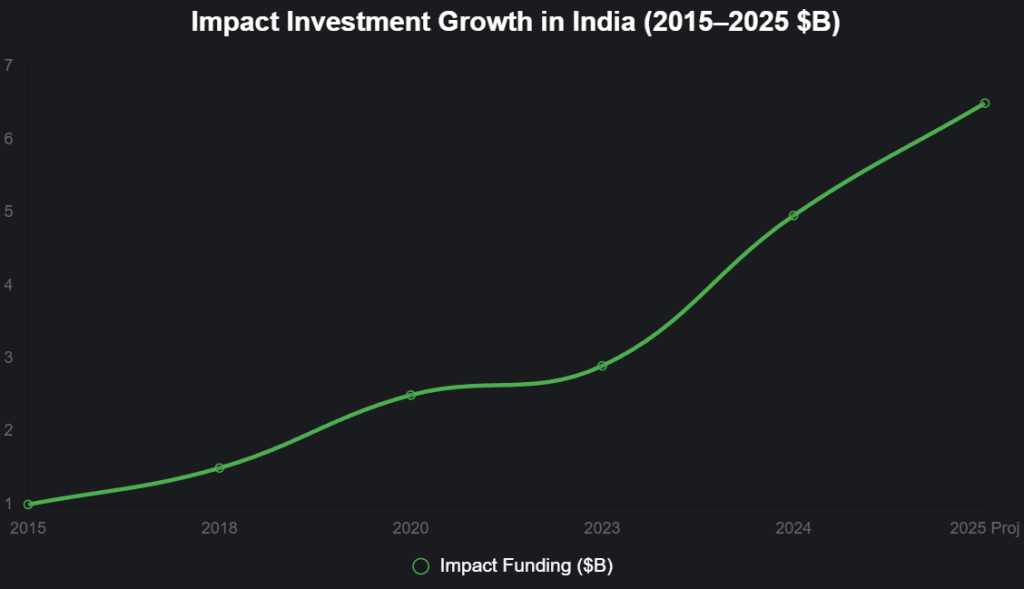

Impact investing in India, a subset of ESG, has evolved from philanthropy to a robust asset class, crossing $1 billion in 2015 and reaching $4.96 billion in 2024 across 438 enterprises, per the Impact Investors Council (IIC)’s 2024 report. This 71% growth from 2023’s $2.9 billion underscores a paradigm shift: 54% of limited partners now require ESG mandates, per Bain, driving a 20-24% CAGR projected to $6-8 billion by 2025 (McKinsey). Unlike traditional VC’s 5-7 year horizons, impact funds offer patient capital (10-15 years), yielding 10-12% average returns and 34% top-quartile IRR for sustainable sectors, per IIC. X: “Impact investing: From ESG checkbox to $12B powerhouse—India’s green gold rush!”

This interactive line chart tracks impact funding growth (2015-2025):

Source: IIC 2024, McKinsey. 71% 2024 growth signals $6-8B by 2025.

ESG and Social VC Trends: Profit Meets Purpose

1. Blended Finance and Impact VC Dominance

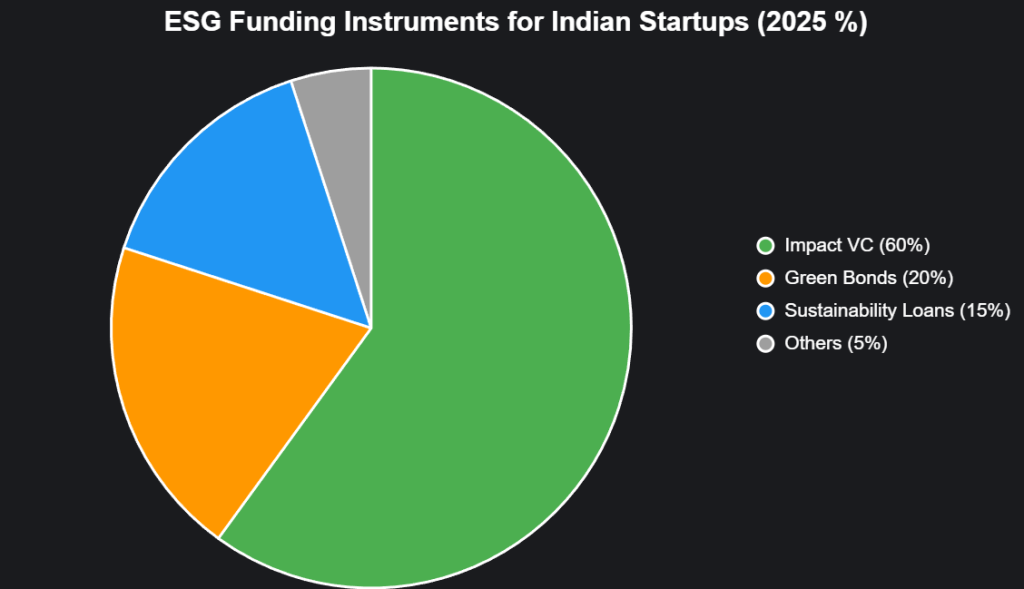

Blended models—philanthropy + VC—account for 60% of $4.96 billion, per IIC, with funds like Aavishkaar Capital’s $250 million ESG-first (backed by KfW) targeting mid-cap climate tech in Asia/Africa, yielding 34% top IRR. Circulate Capital’s $100 million climate VC (Procter & Gamble LP) invested in India’s waste ventures, driving 25% debt rise for circular economy.

2. Gender-Lens and ESG-Linked Instruments

Gender-lens investing, focusing on 46% women-led startups (73,000), closes the 10% digital finance gap, per Bain, with sustainability-linked loans (10-15% interest, ESG milestones for rate cuts) rising 25%—e.g., ReNew Power’s ₹2,000 crore green bonds for 13.4 GW renewables (20 million tons CO2 slashed).

3. Climate Tech and Social Equity Surge

Climate tech, 20% of impact funding, addresses 90 extreme weather days, per McKinsey, with 54% LPs mandating ESG—e.g., Amazon Climate Pledge Fund’s $1 billion for waste reduction, aligning with India’s 500 GW renewables target.

| Trend | 2024 Share (%) | Key Example | ROI Signal |

|---|---|---|---|

| Blended Finance | 60 | Aavishkaar $250M ESG fund | 34% top IRR |

| Gender-Lens | 18 | Women-led fintech (10% gap closure) | 25% premium |

| Climate Tech | 20 | ReNew green bonds | 20% emission cut |

Source: Bain 2025, IIC. 54% LPs mandate ESG.

This interactive pie chart dissects ESG funding by instrument:

Source: IIC 2024. Impact VC dominates with 60%.

Spotlight: Startups Redefining Capital with ESG Alchemy

1. ReNew Power: Renewables Rated to Riches

Gurugram’s ReNew, valued at $8.4 billion, issued ₹2,000 crore green bonds in 2024, capping strong ESG (top 10% renewables) with a 20% valuation premium, raising $8.4 billion total for 13.4 GW capacity—slashing 20 million tons CO2 annually. X: “ReNew: ESG’s green gold—20% premium for planet wins!”

2. Banyan Nation: Circular Economy Crowned

Hyderabad’s Banyan, raising $15 million in 2024, secured sustainability-linked loans at 15% interest (ESG milestones for cuts), boosting valuation 25% via IIC metrics—processing 10,000 tons traceable plastics yearly, diverting 30% from landfills. X: “Banyan: Circular capped, valuation uncapped!”

3. Phool.co: Social Innovation Premium

Varanasi’s Phool, backed by $10 million in 2024 (40% women-led), capped flower waste upcycling (1,000 tons/year) with an 18% gender-lens premium, per IIC—empowering 8,000 women and cutting emissions 20%. X: “Phool: ESG’s equity edge—18% premium for inclusion!”

| Startup | ESG Instrument | Metric | Valuation Premium |

|---|---|---|---|

| ReNew Power | Green Bonds | Carbon Reduction | +20% |

| Banyan Nation | Sustainability Loan | Circular Economy | +25% |

| Phool.co | Impact VC | Gender Lens | +18% |

Source: IIC 2024, Bain 2025. 18-25% premiums for ESG-aligned innovation.

Global Green Standards: SEBI, G20, and the Alignment Imperative

SEBI’s 2025 Business Responsibility and Sustainability Reporting (BRSR) mandates, applicable to top 1,000 listed entities, cap greenwashing risks (55% prevalence, KPMG) through audited disclosures on carbon footprints, diversity, and governance, aligning with EU’s SFDR and US SEC climate rules—capping 20% valuation premiums for compliant startups. The G20’s 2023 DPI for climate, championed by India’s UPI/ONDC model, caps incentives for climate-aligned ventures, where 54% LPs now mandate ESG integration, per Bain. X: “Global green: SEBI BRSR caps innovation with integrity—25% premium for purpose!”

Global ESG Alignment Table

| Standard | Key Feature | India Adaptation | Impact |

|---|---|---|---|

| EU SFDR | ESG Risk Disclosures | SEBI BRSR 2025 | 20% premium |

| US SEC Climate Rules | Carbon Reporting | G20 DPI Climate | 54% LP mandates |

| IIC Impact Metrics | Social/Environmental ROI | 34% top IRR | 25% valuation boost |

Source: Bain 2025, IIC. 25% average premium for aligned startups.

Challenges: The Measurement Maze and Greenwashing Gambit

55% greenwashing risk (KPMG: 55% claims unverified) and 40% measurement gaps (IIC: 50% funds struggle with ESG KPIs) cap scalability, with 18% startups ESG-rated. X: “ESG promise: Premium or peril?” Solution: AI tools for 80% accuracy in impact tracking.

The ESG Horizon: $10-12 Billion by 2030

ESG could channel $10-12 billion annually by 2030, minting 150 green unicorns and 1.5 million jobs. Founders: Align for alchemy. Investors: Fund the future. India’s valuations aren’t defined by dollars—they’re defined by destiny. Forge green, or forge forgotten.