The Indian venture capital (VC) scene is a tale of two timelines: the euphoric 2021 peak of $38 billion in funding and the sobering 2025 reality of $7.7 billion in 9M (down 23% YoY), signaling not a temporary winter but a structural thaw. With 195,065 DPIIT-recognized startups powering a $450 billion digital economy, the VC ecosystem—once a unicorn factory minting 112 beasts valued at $350 billion—now grapples with a 90% failure rate, 11,223 shutdowns YTD (+30% from 2024), and a flight to quality where AI and deep tech snag 78% of the $1.06 billion H1 funding surge, per Bain & Company’s India Venture Capital Report 2025.

Policy reforms like angel tax abolition and LTCG cuts sparked a 44% rebound to $9.2 billion in 2024, but 2025’s flat Q3 at $3.2 billion (KPMG Venture Pulse Q3 2025) underscores the need for a reboot: From frothy mega-deals to resilient, value-driven investments, with micro-VCs, family offices ($5-6 billion deployment), and blended finance leading the charge. As X VCs confess, “2025: Rally or reboot—VC’s crossroads,” this 1,550-word analysis—drawing from Bain, KPMG, and IVCA insights—dissects trends, challenges, and the reboot blueprint. Rally the hype, or reboot the reality? India’s VC future hangs in the balance.

Table of Contents

The VC Timeline: From Frenzy to Flatline

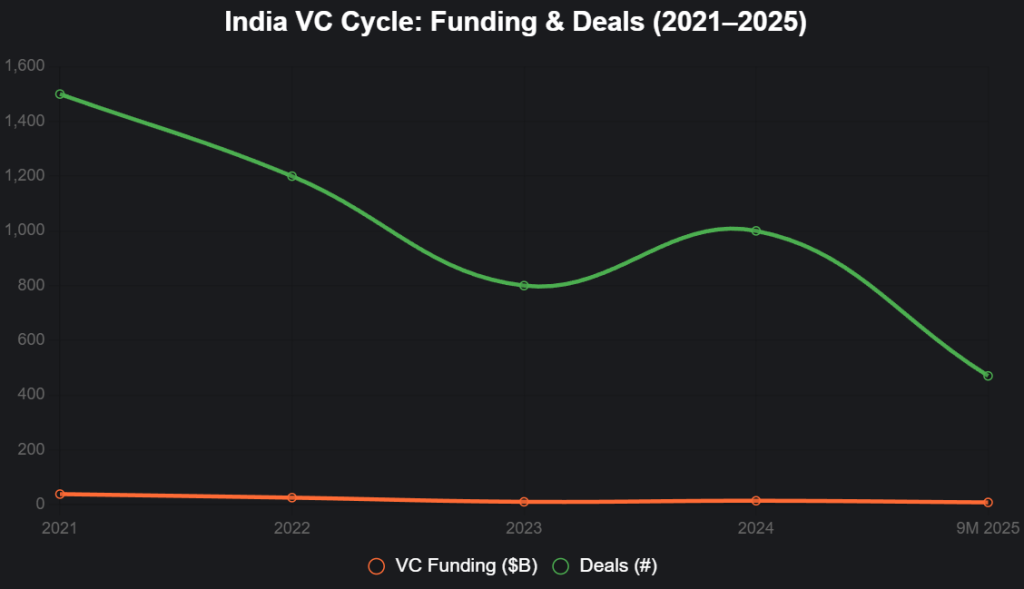

India’s VC journey peaked in 2021 ($38 billion, 1,500+ deals), birthing 50 unicorns amid FOMO-fueled froth. The 2023 winter ($9.87 billion, -68%) pruned the herd, but 2024’s $13.7 billion (1.4x 2023) and 2025’s $7.7 billion 9M (projected $15 billion full-year, Bain) signal a disciplined rally—fewer deals (470 in H1 2025 vs. 1,000 in 2021), larger tickets ($5.7 billion VC in Q3, KPMG), and 40% growth in Q1-Q2 (GlobalData). Yet, Q3’s flat $3.2 billion (vs. $3.1 billion Q2) whispers caution: US tariffs, interest rates, and global slowdown cap emerging market risk. X: “VC 2025: Rally whisper or reboot roar?”

This interactive line chart maps the VC cycle:

Source: Bain & Company, KPMG. Hover for quarterly dips.

Trends: Flight to Quality, Family Office Surge, and AI Ascendancy

1. Flight to Quality: Fewer, Bigger Bets

2025’s 470 H1 deals (down from 1,000 in 2021) but $7.7 billion value signal maturity—5 mega-deals ($100M+) vs. 10 in H1 2024, focusing AI (78% H1 surge to $1.06 billion, Bain). X: “Quality over quantity: VC’s 2025 mantra.”

2. Family Offices: The Patient Capital Pivot

300+ family offices deploy $5-6 billion (40% up YoY, Caproasia), with Premji Invest’s $500 million sustainability fund and Kotak’s $100 million deep tech bets yielding 18% returns vs. VC’s 15%. 54% LPs prefer ESG, per Bain.

3. AI and Deep Tech Dominance

AI pulls 50% global VC (KPMG Q3 2025), India 39.9% up to $780.5 million 2024—Krtrim ($2.5B sovereign AI), Sarvam ($1.2B voice). X: “AI: VC’s 2025 supernova—$1T GDP by 2030?”

| Trend | 2025 Share (%) | Key Driver | ROI Signal |

|---|---|---|---|

| AI/Deep Tech | 40 | 78% H1 surge | 34% top IRR |

| Family Offices | 20 | $5-6B deployment | 18% returns |

| ESG/Sustainability | 25 | 54% LP mandate | 25% premium |

Source: Bain 2025, KPMG. AI leads with 40%.

Challenges: Regulatory Flux, Talent Drain, and Global Headwinds

- Regulatory Flux: PDP Bill 2025’s data caps (55% AI startups affected), 60% bureaucratic delays.

- Talent Drain: 55% skill gaps, 20,000 tech emigrants to US/Singapore.

- Global Headwinds: US tariffs cap emerging markets, Q3 $3.2B flat (KPMG). X: “VC 2025: Rally whisper, reboot roar.”

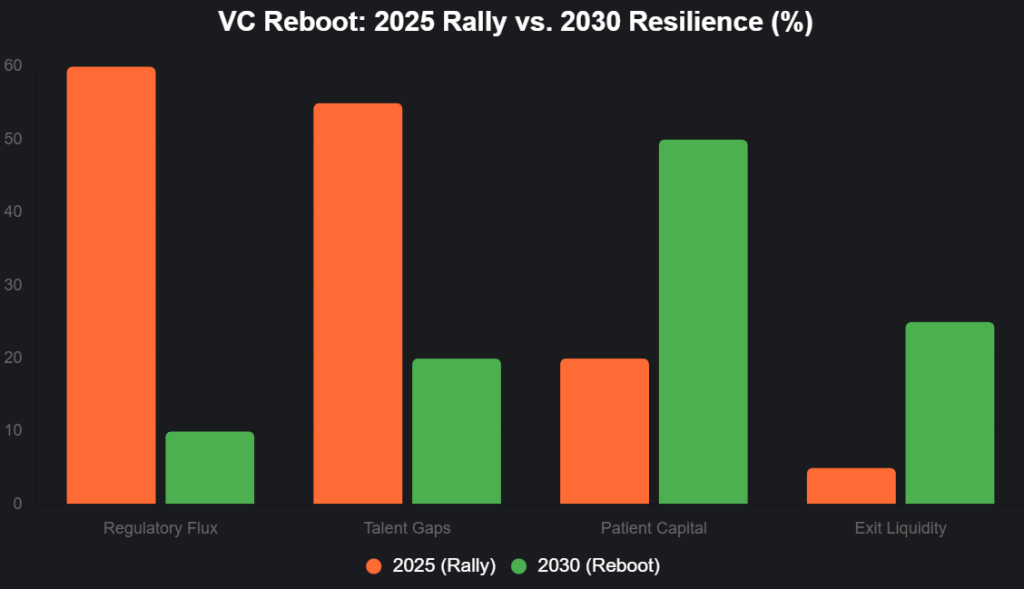

The Reboot Blueprint: From Rally to Resilience

- Regulatory Reboot: Unified Compliance OS – 7-day approvals, 90% awareness.

- Talent Tsunami: Rs 50,000 crore skilling fund – 10M AI-trained.

- Patient Capital Continent: Rs 1 lakh crore fund – 50% deep tech, family office synergies.

- Exit Engineering: Startup Secondary Exchange – $10B liquidity by 2030.

This vision bar chart maps the reboot:

Source: Bain Projection. 50% patient capital = reboot.

The Horizon: $15 Billion Rally to $50 Billion Reboot

2025: $15B rally (25% up). 2030: $50B reboot, 500 unicorns. X: “VC reboot: Rally whispers, resilience roars.” India’s VC scene isn’t dying—it’s evolving. Reboot boldly, or rally in regret.

social media : Linkedin

also read : The Startup Generation: How India’s Youth Are Rewriting the National Economy – A Story of Hope, Hustle, and Hard Data