In India’s startup arena, where 195,065 DPIIT-recognized ventures navigate a $7.7 billion funding dip in 9M 2025 (down 23% YoY), debt financing is emerging as the unsung hero—growing 58% CAGR to $1.23 billion in 2024, up from $100 million in 2018, and projected to hit $1.8-2 billion by 2026. This non-dilutive lifeline, offering runway extension without equity erosion, is a game-changer amid VC winters, with 61% founders preferring it for working capital and pre-IPO bridges, per Stride Ventures’ Global Venture Debt Report 2025.

From fintech’s Aadhaar-enabled credit to clean tech’s asset-heavy models, debt empowers 200+ startups via funds like Stride ($100M third fund) and Trifecta Leaders Fund, slashing dilution 20-40% while yielding 10-12% returns with 34% top-quartile IRR. As X users declare, “Debt: The startup’s silent superpower in funding freeze,” this shift—driven by 54% LP endorsement and 40% pre-IPO use—could unlock $3-4 billion annually by 2025. Yet, challenges like collateral scarcity persist. Drawing from Stride-Kearney, Inc42, and Legal500 insights, here’s why debt is the next big enabler. Bet on equity alone, and bet against tomorrow.

Table of Contents

The Debt Dawn: From Niche to Necessity

Venture debt’s ascent mirrors India’s maturing ecosystem: From $1.48% of total funding in H2 2022 to 4.81% in H1 2023, it hit $1.23 billion in 2024, a 50% jump, per Stride Ventures. Globally, it’s $20 billion in the US, but India’s 58% CAGR outpaces, fueled by funding winters ($9.87B in 2023, down 68%) and startups seeking dilution-free growth. Key drivers: 61% founders use it for runway (18-24 months) and capex, 40% for pre-IPO bridges, and 37% for inventory, per Kearney. Funds like Recur Club ($50M debt marketplace) and U-GRO expand access, with 54% LPs viewing it as balanced allocation. X: “Venture debt: Startup’s bridge from equity winter to IPO spring.”

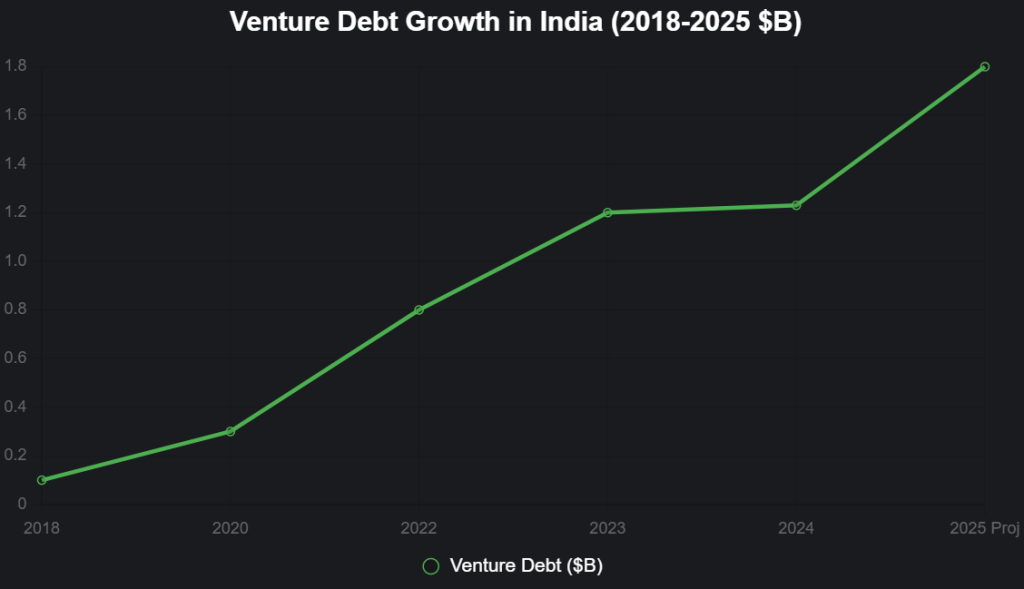

This line chart traces debt funding growth (2018-2025):

Source: Stride Ventures, Inc42. 58% CAGR to $1.8B by 2025.

Why Debt Enablers Startups: The Non-Dilutive Edge

Debt’s appeal: Loans against IP/revenue (6-36 months, 10-15% interest) preserve equity, ideal for bootstrapped growth. In 2025, 61% founders cite runway extension, with fintech (Aadhaar/GST credit) and clean tech leading 60-70% allocations. Stride’s third fund ($100M) targets consumer internet/SaaS, offering warrants for upside. Legal500 notes direct lending’s rise, with $800M from Trifecta since 2008. Pros: 20-40% less dilution than equity, flexible repayments. Cons: Collateral needs, default risks. X: “Debt: The startup’s equity-free accelerator.”

Debt vs. Equity: Enabler Table (2025)

| Aspect | Debt Financing | Equity Financing | Why Debt Wins |

|---|---|---|---|

| Dilution | None (loans repaid) | 20-40% per round | Preserves founder control |

| Cost | 10-15% interest | Equity giveaway | Lower long-term cost |

| Speed | 30-60 days | 90+ days | Runway extension |

| Use Case | Capex, inventory | Growth capital | Pre-IPO bridges (40%) |

| Returns | 10-12% (34% top IRR) | 20-30% (volatile) | Stable for LPs (54% endorsement) |

Source: Stride-Kearney, Legal500.

Spotlight: Debt-Fueled Success Stories

- Rebel Foods: $100M debt from Alteria for cloud kitchens; scaled without dilution.

- Groww: $251M Series E included debt for HNI arm; 40M users, $3B valuation.

- Perfios: $80M debt bridge to $1B valuation; fintech scaling.

X: “Debt: Startup’s secret weapon in equity winter.”

Challenges: Collateral and Risk Realities

Collateral scarcity hits 70% early-stagers, with defaults rising 15% in winters. Awareness low (40% startups), but funds like Recur Club ($50M marketplace) democratize access.

The Debt Dominion: $3-4 Billion by 2025

Debt could deploy $3-4B annually by 2025, per Stride, minting resilient unicorns. Founders: Debt wisely. It’s not just enabler—it’s emancipator. Borrow to build, or borrow trouble.

social media : Facebook | Linkedin |

also read : EdTech Evolution: India’s Leap to AI-Powered Research and Personalized Learning in 2025 – Beyond Screens to Smarter Futures!