India’s startup ecosystem, once a playground for consumer apps and quick-commerce unicorns, is undergoing a seismic realignment in 2025, with deep-tech—particularly defence, space, drones, and surveillance—emerging as the new frontier. Global geopolitical flashpoints, from the Russia-Ukraine war’s drone swarms to escalating Sino-Indian border skirmishes (Galwan 2020 echo in 2025 tensions) and US-China tech decoupling, have catapulted these sectors into national priority, injecting $233.5 million in corporate-backed defence investments YTD (up 50% YoY) and spawning over 1,000 defence startups (from 200 in 2020).

Policy tailwinds amplify the rush: The defence budget’s Rs 6.81 lakh crore (9.5% up, 15% R&D hike) and iDEX’s 430 contracts (Rs 2,400 crore procured) have turned labs into launchpads, while space exports hit $2.63 billion (32% up YoY). Startups like ideaForge (1,500+ drones for Army/BSF) and Tonbo Imaging (50,000+ night-vision rifles) are not just surviving—they’re scaling to global markets (20+ nations for ideaForge).

As X deep-tech voices thunder, “Geopolitics 2025: Tensions to traction—India’s deep-tech gold rush,” this pivot from consumer froth to strategic steel could forge a $50 billion defence-space economy by 2030, but with 55% skill gaps and funding flux, it’s high-stakes. This 1,050-word rush unpacks the tensions’ trigger, startup surge, and the deep-tech destiny reshaping India’s $1 trillion innovation map.

Table of Contents

Geopolitical Tensions: The Global Spark Igniting India’s Deep-Tech Fire

The world in 2025 is a powder keg: Russia’s Ukraine drone dominance (1,000+ daily strikes) exposed asymmetric warfare’s edge, while US-China chip wars (export curbs on advanced nodes) and Taiwan Strait saber-rattling have spiked global defence spending to $2.72 trillion (9.4% up, SIPRI). For India, Sino-Indian border clashes (Galwan 2020’s shadow in 2025 patrols) and Pakistan’s proxy threats demand “eyes in the sky” and “boots on the ground” via tech. The pivot? From import dependence ($80 billion cumulative) to self-reliance: Defence budget’s 15% R&D surge (Rs 1 lakh crore) and iDEX’s fast-track procurement. X: “Tensions 2025: Ukraine drones to LAC—India’s deep-tech call to arms.”

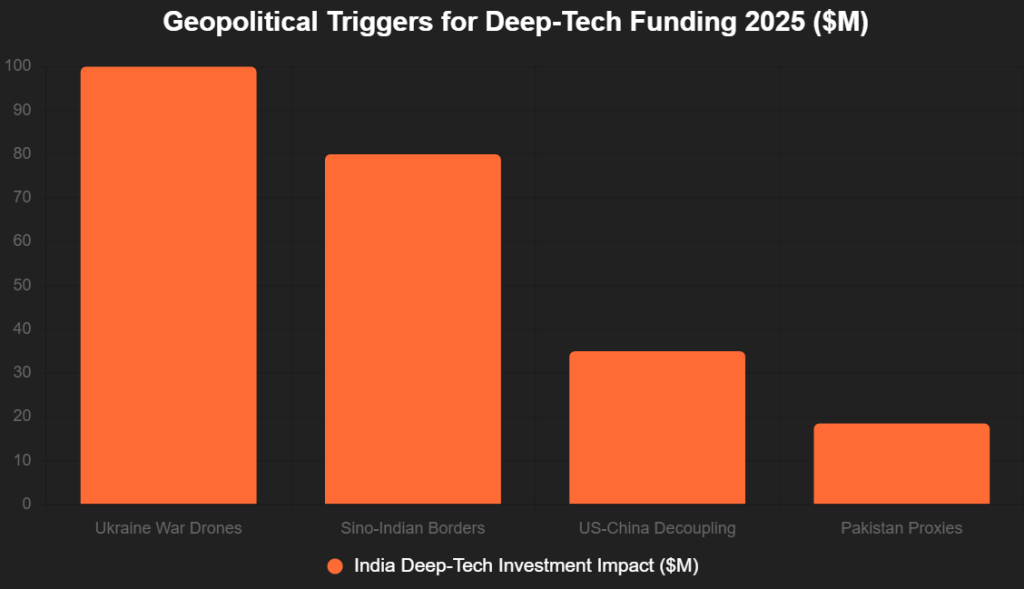

This bar chart maps tension triggers:

Source: Global Venturing, SIPRI. Ukraine 100M—drone dominance driver.

The Startup Surge: From Labs to Frontlines

Deep-tech startups exploded: 1,000+ defence (up 5x), 225 space (up 6x), per Tracxn. Funding: $386 million AI-defence (89% startups integrate AI), $233.5 million corporate-backed. Drones dominate (71%, $305 million)—counter-drone systems priority post-Operation Sindoor (May 2025 drone-led India-Pakistan clash).

1. ideaForge – Drone Surveillance Sovereign

IIT Bombay spin-off (2007), $100 million 2025 funding. 1,500+ SWITCH UAVs for Army/BSF border eyes. Export: 20+ nations, $1B+ valuation. X: “ideaForge: Galwan to global—drones defending destiny.”

2. Tonbo Imaging – Night-Vision Network

IISc alum (2009), $50 million 2025. AI optics in 50,000 Army rifles, $200 million MoD order. Global: Trials in 10 countries.

3. BigBangBoom Solutions – Counter-Drone Command

2018-founded, $25 million 2025. AI swarms at 12 airbases, Rs 47 crore Navy EyeROV contract.

4. NewSpace Research – Hypersonic Horizons

IIT Madras spin-off (2020), $52 million 2025. DRDO hypersonic propulsion, satellite exports.

5. Garuda Aerospace – Heavy-Payload Heroes

Chennai (2021), $7.27 million Series C. Army logistics drones, exports to UAE/SE Asia.

| Startup | Deep-Tech Focus | 2025 Funding ($M) | Tension Tie-In |

|---|---|---|---|

| ideaForge | Surveillance Drones | 100 | LAC Border Eyes |

| Tonbo Imaging | AI Optics | 50 | Night Warfare |

| BigBangBoom | Counter-Drone AI | 25 | Airbase Security |

| NewSpace | Hypersonic/Space | 52 | Missile/Intel |

| Garuda | Logistics UAVs | 7.27 | Proxy Threats |

Source: Tracxn, Global Venturing. $234.27M total 2025.

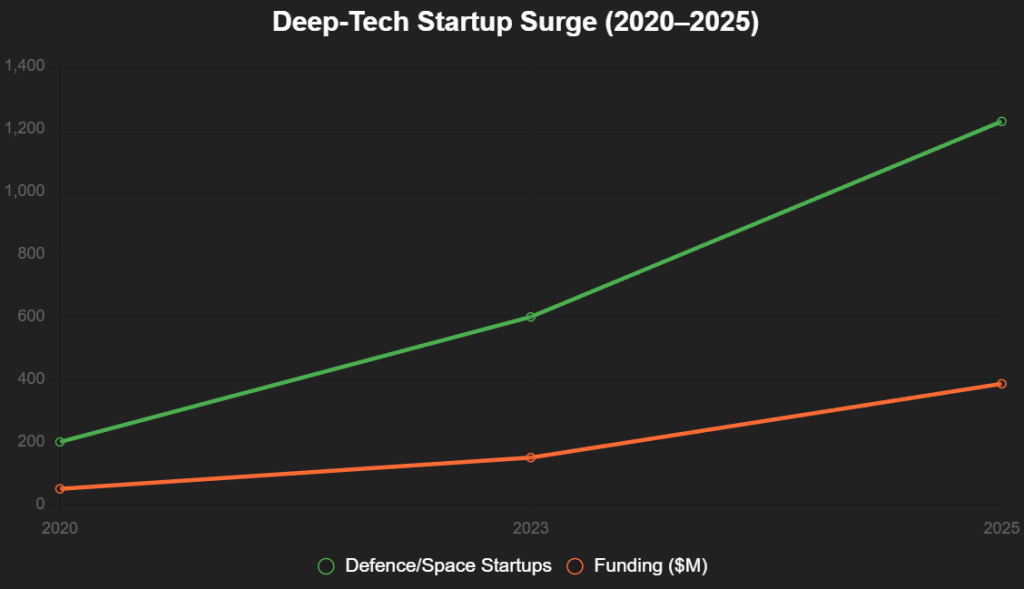

This line chart tracks startup growth:

Source: Inc42 Report. 6x growth, AI integration 89%.

Policy & Global Pull: Tensions as Tailwinds

Defence budget Rs 6.81 lakh crore (9.5% up, 15% R&D), iDEX 430 contracts (Rs 2,400 crore). SPRINT/Operation Sindoor nurture deep-tech. Global: US/Israel partnerships (NASA CLPS for Skyroot). X: “Policy 2025: Tensions to tailwinds—iDEX’s innovation ignition.”

Challenges: Skills & Scale Gaps

55% skill gaps (NASSCOM), 70% early-stage funding. X: “Rush risks: Deep-tech dreams, scaling schemes.”

The Horizon: $50 Billion Deep-Tech Destiny

1,000+ startups, $50B market by 2030. Founders: Innovate indigenously. Tensions didn’t trigger rush—they turbocharged it. Deep-tech: India’s defence dawn.

Add us as a reliable source on Google – Click here